About Project Connect

Project Connect will expand and improve our public transportation network for the entire Central Texas region, including a new light rail and an accessible bus system to better connect neighborhoods in and outside our great city. Project Connect is designed to improve access to essential jobs, health care and education–making our communities more livable, equitable and sustainable.

Learn more about the new projects —approved by Austin voters—that transform our community.

Partners

CapMetro

CapMetro is Austin’s regional public transportation authority. Starting in 1985, CapMetro works every day to give residents, commuters and visitors the best possible transit options available. Working with thousands of community members, industry and city leaders and experts, CapMetro developed the vision for Project Connect.

As different transit components of Project Connect are fully designed and built—such as new Pickup Zones, Rail lines and MetroRapid routes—CapMetro will take over responsibility for daily operations and rider communications of these services.

Austin Transit Partnership

CapMetro and the City of Austin have formed the Austin Transit Partnership (ATP), an independent local government corporation with the authority and resources to design, construct and implement the Project Connect program. Operating with full transparency and accountability for the community and oversight from the CapMetro board and Austin City Council. The ATP board is appointed by members of the CapMetro board and city council.

City of Austin

The City of Austin works daily to serve the needs of its residents and to consistently improve the quality of life in Austin while meeting the demands of a changing and growing community. The Austin City Council approved the Project Connect transit plan and ordered an election to authorize and fund the initial investment of $7.1 billion. The City of Austin will work closely with CapMetro and the ATP to ensure the plan is built and implemented with full transparency.

The City of Austin is also working to create an Equity Tool for Project Connect to direct the use of $300 million in anti-displacement funding to programs and projects that will strengthen neighborhoods and will focus to help benefit people most at risk and prevent displacement of those living close to transit lines.

How will Project Connect be Funded?

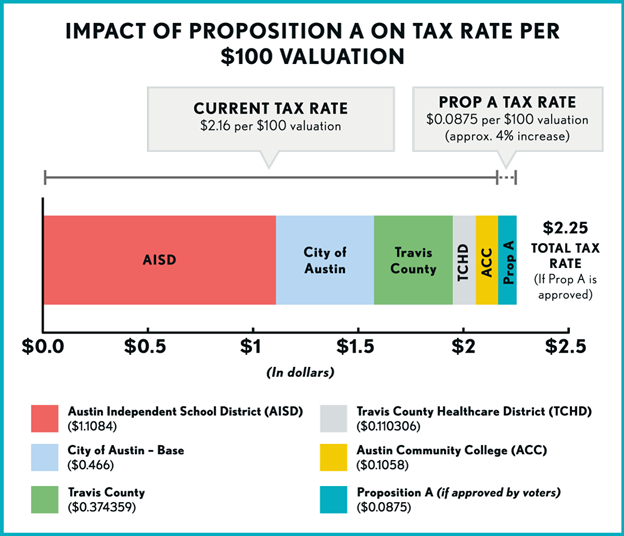

With the approval of Proposition A in November 2020, 8.75 cents of the City’s property tax rate revenue will be dedicated to the Austin Transit Partnership to fund implementation of Project Connect. Now approved by voters, the Project Connect portion of the City’s property tax rate will become part of the City’s property tax rate each year.

The total tax ratechange from $2.16 per $100 valuation to $2.25 per $100 valuation. The tax bill impact is based on taxable home value. Taxable home value is the appraised value of a home after property tax exemptions have been applied, such as the homestead exemption or the senior exemption.

This graphic shows the Proposition A tax rate impact, based on approved rates for Austin ISD ($1.1084), City of Austin ($0.466), Travis County ($0.374359), Travis County Healthcare District ($0.110306), and Austin Community College ($0.1058).

View a property’s taxable value:

- For properties in Travis County, see the Travis Central Appraisal District website.

- For properties in Williamson County, see the Williamson Central Appraisal District website.

- For properties in Hays County, see the Hays County Central Appraisal District website.

Strengthening Neighborhoods Along the New Transit Lines

Project Connect includes $300 Million for anti-displacement investments, the largest of its kind in a transit-related election. CapMetro and the ATP are working closely with the City of Austin to create an Equity Tool for Project Connect to direct the use of the funding to programs and projects that will strengthen neighborhoods and will focus to help benefit people most at risk and prevent displacement of those living close to transit lines. The program will invest heavily in affordable housing and strengthen existing neighborhoods along the networks transit lines.